April 11, 2023

The Kenyan government says it is unable to pay civil servants, including Members of parliament, their March 2023 salaries because of financial challenges. Kenya’s Deputy President said that the money collected in the last two weeks by the Kenya Revenue Authority was meant to pay salaries, but was instead used to repay government loans that had matured. According to David Ndii, Chair of the President's Council of Economic Advisers, unusually heavy maturities in March, where the government paid Ksh.150 billion (approx. USD1.12 billion) of maturing bonds and bills, and a couple of market movements caused by the US Treasury raising its rates and Central Bank of Kenya raising the central bank rate (CBR) by 75 basis points last week, have created a situation where the market is adjusting. Ndii further explained that last year, the government planned to raise a billion dollars from the international market, but they went too late and were not able to secure funding. As a result, the government ended the year with a $120 billion hole, which had consequences for both the fiscal and liquidity side of the economy. He further says the government is currently trying to fill that hole by borrowing from the domestic market and is experiencing maturities that are bunching up, causing delays in civil servants' salaries.

By December 2022, Kenya’s public debt had crossed the KSh9 trillion (USD 67bn) mark, as the Kenyan government planned to borrow another KSh720 billion (approx. USD 5.3 billion), which would raise public debt. Admitting to the challenge, Finance Cabinet Secretary Prof Njuguna Ndung’u said government workers will have to tighten their belts, indicating that more salary delays are in the offing. The Cabinet Secretary noted that the government is in a financial fix with nowhere to get more funds.

Lifting the lid on the cash crunch, Prof Ndung’u said the national government is facing financial constraints as it is caught between underperforming revenues and limited access to finance due to narrowing borrowing headroom. Stopping short of saying the government is “broke”, he said the situation has seen several government programmes stall, including disbursement to the counties and investment projects with most of the funds going towards debt financing. On average, Treasury requires about Ksh50 billion (approx. USD 373 million) monthly for civil servants’ salaries and another Ksh8 billion for payment of pensions. Several staff working in ministries, departments and agencies have been affected by the delays with most going for Easter Holidays without pay. As a result, Kenya’s civil servants have been warned to brace themselves for more salary delays amid a worsening economic situation in the country.

For example, at the Independent Electoral and Boundaries Commission (IEBC), chief executive officer Marjan Hussein Marjan told IEBC staff they are experiencing delays in processing and disbursement of March salaries with Treasury failing to give the agency a definite date when the money will be released even after requesting for it on March 23, 2023. With the Kenya Revenue Authority having missed its latest revenue target by a whopping Ksh67 billion (approx. USD 500 million), the Treasury struggled to raise funds for disbursement to counties and even to ministries, departments and agencies (MDAs) with county governments owed Ksh92.5 billion (approx. USD 695 million) in delayed January, February and March equitable revenue share remittances and Ksh204 billion (approx. USD 1.5 billion) to MDAs. At the moment, MDAs are awaiting payment of recurrent expenditures of Ksh96.5 billion (approx. USD 721 million), development funds of Ksh55 billion (approx. USD 411 million) and pensions amounting to Ksh53 billion (approx. USD 396 million).

While appearing before the Senate County Public Investment and Special Funds Committee late in March 2023, National Treasury Principal Secretary Dr Chris Kiptoo pointed out that the current cash crunch cannot allow Exchequer to settle outstanding debts. He explained that Treasury always prioritises public debt repayment as well as statutory payments such as pensions, which form the first charge on the Consolidated Fund taking at least 65 per cent of revenue raised by the national government. Dr Kiptoo told the committee that, for instance, the Treasury spent Ksh150 billion to repay public debt in March alone. The government collected Sh1.83 trillion (about USD 13 billion) between July 1, 2022 and February 28, 2023. Out of this, Ksh727 billion (about USD 5.4 billion) (40 per cent) was used on recurrent expenditure and Ksh694 billion (about USD 5.1 billion) (38 per cent) on public debt. Between July and December 2022, the government spent Ksh526 billion (about USD 3.9 billion) to pay domestic and external creditors, a massive 32.8 per cent or Ksh130 billion (about USD 971 million) rise from the Ksh396 billion (about USD 2.9 billion) in a similar period the previous year. This was from the Ksh952.6 billion (about USD 7.1 billion) collected by KRA during the period under review.

The Chairman of Presidential Council of Economic Advisors, Dr David Ndii, while defending the government, blamed the crisis on multiple loans maturing in their billions, yet revenue is not growing in tandem. Kenya remains at high risk of debt distress after the public debt crossed the Ksh9 trillion mark in December with the government planning to borrow Ksh720.1 billion (about USD 5.3 billion) in the next financial year, which could raise the public debt to over Ksh10 trillion (about USD 74.7 billion) by June 2024. In fact, the Treasury has tapped four international banks – CitiGroup, Rand Merchant Bank, Standard Chartered Bank, and Standard Bank – to arrange for a Sh76.8 billion (about 573 million) syndicated loan to plug the 2022/23 budget deficit. The government is looking to raise the planned syndicated loan in two tranches – one maturing in three years and another payable in five years. Kenya is also eyeing $750 million in low-cost loan financing from the World Bank before June 30, 2023.

President William Ruto has repeatedly cited public debt as the biggest challenge facing his new administration, while castigating his predecessor Uhuru Kenyatta for borrowing expensive, commercial loans from external lenders. The last syndicated loan Kenya borrowed was a $300 million facility (Sh38.4 billion as per current exchange rate) raised just before the August 2022 General Election, in an arrangement led by the Trade Development Bank.

While deviating from their manifesto of inter alia, minimizing government borrowing, it is surprising to observe that the Ruto administration borrowed nearly KSh500 billion (approx. USD 3.7 billion) in the first four months into office, pointing to a sustained borrowing appetite by the new government. Recently, the Cabinet approved a decision to abandon the country’s KSh10 trillion (approx. USD 74.7 billion) debt ceiling in favor of a floating target of 55% of GDP. The National Treasury, through Supplementary Budget I 2022/23, proposed to recalibrate borrowing in the current financial year with a bias for more externally-sourced financing. It plans to slash domestic borrowing for the current financial year from KSh581.7 billion (approx. USD 4.3 billion) to KSh415.5 billion (approx. USD 3.1 billion) and increase external borrowing from KSh280.7 billion (approx. USD 2 billion) to KSh378.9 billion (approx. USD 2.8 billion). President Ruto’s administration in January released its Budget Policy Statement that showed a proposed KSh251 billion (approx. USD 1.9 billion) increase in the National Budget to KSh3.64 trillion (approx. USD 27.2 billion).

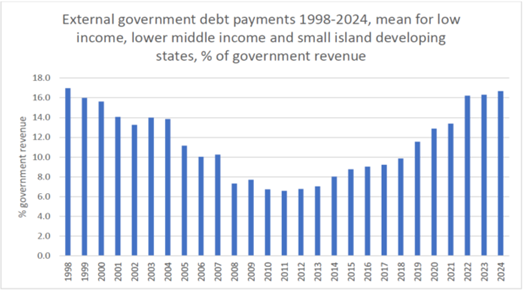

Shockingly, Kenya’s debt situation is not unique. Low-income countries will face their biggest bills for servicing foreign debts in a quarter of a century this year, putting spending on health, education, and other public utilities at risk. According to Debt Justice, repayments on public debt owed to non-residents for a group of 91 of the world’s poorest countries will take up an average of more than 16% of government revenues in 2023, rising to almost 17% next year, an increase of over 150% since 2011.

Source: Debt Justice

As shown in the figure above from Debt Justice, the figures – the highest since 1998 – follow a steep rise in global borrowing costs last year, when central banks sought to counter inflation with rapid rate rises. As a result, countries with scheduled external debt payments over 30% of government revenue between 2022-2024 include Sri Lanka, Laos, Pakistan, Zambia and Dominica. It is expected that the rising debt servicing costs in the Global South (excluding China) will exacerbate the ongoing discussions on debt forgiveness.

As correctly noted by Heidi Chow, Executive Director of Debt Justice:

“Debt payments are reaching crisis levels in many countries, hindering the ability of governments to provide public services, fight the climate crisis and respond to economic turmoil. There’s no time to waste, we urgently need fast and comprehensive debt relief schemes across all external creditors, including legislation in the UK and New York to make private lenders take part in debt cancellation.”

Chow, therefore, calls for “fast and comprehensive” relief on external debts, including changes to laws governing bond contracts in England and the state of New York to force private creditors to take part in debt cancellation.

Therefore, hoping that these debt challenges faced by Kenya and other developing countries will be top of the agenda in the ongoing IMF and World Spring meetings, coupled with the need for the reform of the global financial and debt architecture, the African Sovereign Debt Justice Network (AfSDJN) calls upon the IMF and the World Bank to increase concessional financing for climate action and address urgent liquidity needs of African countries without exacerbating their indebtedness. Additionally, the AfSDJN also calls upon the Bretton Woods Institutions to:

- Commence deliberations on a new comprehensive, fair and effective sovereign debt restructuring mechanism based in the United Nations that would be binding on all creditors, including private creditors.

- Support the incorporation of natural disaster and pandemic clauses across sovereign debt instruments, including during restructurings, allowing countries to defer principal and interest payments in the event of the occurrence of natural disasters and pandemics.

- Ensure that ongoing debt restructurings undertaken under the aegis of the IMF are austerity free.

- Review their debt sustainability assessments to ensure that they do not encourage the excessive accumulation of debt and take into consideration the required investment in sustainable development goals (SDGs), climate needs, and human rights of populations in African countries.