September 26, 2022

The COVID-19 pandemic has inflicted significant damage on African economic activities, exacerbated fiscal challenges in African countries, and also impeded their ability to respond to the pandemic and achieve the Sustainable Development Goals. As a result, the first half of 2021 (2021H1) was characterised predominantly by negative rating actions owing the continued economic challenges faced by countries as they deal with Covid-19 infection phases and waves, and at the same time, investing in recovering from the pandemic. A total of 7 African countries – Botswana, Cape Verde, Ethiopia, Mauritius, Morocco, Kenya and Tunisia – were downgraded in the 2021H1, whilst 1 country – Zambia – had its credit rating outlook changed from stable to negative. Morocco, one of the three African countries that were still rated above ‘junk’ status, lost its investment grade by S&P, after Fitch had already downgraded it to ‘junk’ in the second half of 2020 (2020H2).

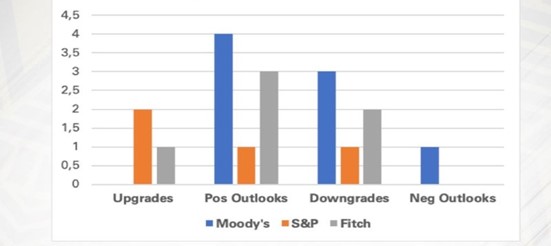

A year later, the ratings worsened. The 2022H1 was predominantly associated with more sovereign rating downgrades than upgrades. According to the Africa Peer Review Mechanism, five countries were downgraded – Burkina Faso, Ghana, Mali, Namibia and Tunisia – compared to only two upgrades – Angola and Democratic Republic of Congo (DRC). The downgrades more than doubled in the 2022H1 from those witnessed in the second half of 2021 (2021H2), where only Ethiopia and Tunisia, which were going through political unrest, were downgraded. The rating downgrades in 2022H1 indicates a moderate reversal in the improvement of creditworthiness across the continent in the 2021H2, reflecting the effects of fiscal debt that was accumulated during the height of the Covid-19 pandemic, whose interest repayments are unsustainably high. As shown, since the beginning of the first half of 2020 (2020H1), credit rating downgrades and negative outlooks have been on an upward trend. This was mainly driven by the prospects of faster and stronger economic recovery as countries emerged from the devastating impact of the COVID-19 pandemic, as well as the impacts of the Ukraine-Russia war. Globally, developing countries have borne the brunt (approximately 95%) of credit downgrades despite experiencing relatively milder economic contractions. The fear of credit rating downgrades also hindered some countries’ participation in official debt relief programs such as the G20 Debt Service Suspension Initiative (DSSI).

Table 1: Sovereign Rating Actions in Africa between Jan-Jun 2022

Source: Africa Peer Review Mechanism

Notably, Credit Rating Agencies (CRAs) play a pivotal role within the financial sphere. They provide a solvency risk benchmark to investors for debt issuers and structured finance instruments which are traded on debt capital markets. In short, they have an outsized influence on the interest rates countries or corporates pay lenders. According to the UN Department of Economic and Social Affairs (UN DESA), three challenges related to developing country sovereign credit ratings stand out: (a) the impact of downgrades on countries’ cost of borrowing and on financial market stability, including whether is perceived bias, increased volatility and ‘cliff effects’; (b) how official actions, including official debt restructuring such as DSSI, are incorporated into ratings analysis; and (c) the integration of climate change and other non-economic factors into rating methodologies. In Africa, particularly, common concerns that have been raised against credit rating agencies include potential conflicts of interest, unreliable methodologies, and a lack of understanding of African economies. Furthermore, there are concerns surrounding the oligopolistic nature of the ‘big three’ – Moody’s, S&P, and Fitch Ratings – rating agencies. For example, in February 2022, Moody’s downgraded Ghana’s long-term foreign currency sovereign rating from B3 to Caa1, on account that the country faces an increasingly difficult task of addressing liquidity and debt challenges.

The ‘big three’ have also been accused by African Heads of State and Government, policy-makers, and academics, of being politically weaponised as punitive sanctions against certain states that fail to align to the preferences of the Western countries. For example, in March 2022, the European Union (EU) issued a directive banning EU credit rating agencies from rating Russia and Russian firms as part of its sanctions package against Russia’s invasion of Ukraine, failure of which they would risk losing their licenses. It is, therefore, arguable that the free-fall downgrades of the Russian government by six notches in less than 15 days, was not driven by risk fundamentals but rather a politically subjective reaction by the international CRAs. These challenges in the sovereign credit ratings sector have further diminished confidence in operations and the accuracy of ratings assigned by the three international credit rating agencies in Africa.

As a result, there has been a renewed focus by African leaders who continue to raise concerns over the unsatisfactory business practices by the three dominant international credit rating agencies, and are calling for a more sustainable and long-term solution. On 21 September, 2022, during the 77th Session of the UN General Assembly, Ghana’s President Nana Akufo-Addo urged African leaders to guard against the continuing consequential power of rating agencies on African economies. The President called for an urgent reform of the international financial system, as the current monetary system is skewed against developing countries. According to the President, the financial markets have been set up and operate on rules designed for the benefit of rich and powerful nations, and, during times of crisis, the façade of international co-operation, under which they purport to operate, disappears.

Regionally, the African Union, through the Africa Peer Review Mechanism, is exploring a lasting solution to the high cost of capital in Africa. Among other solutions, the AU plans to establish an African Credit Rating Agency (ACRA) as an independent entity to provide alternative and complementing rating opinions for the Continent, on the basis of self-sustainability, political, and financial autonomy. Domestically, and as a welcome development, the appetite for changing the industry structure has seen more domestic rating agencies emerging on the continent. For example, Egypt’s Financial Regulatory Authority (FRA) approved a new amendment to the licensing and share-ownership rules of credit rating companies, allowing the establishment of local credit rating companies. Domestic rating agencies have the potential to contribute to the sector’s performance, creating a competitive atmosphere in the market and increasing bond issuance, especially the domestic instruments market. In Ghana, the Security and Exchange Commission (SEC) of Ghana licensed Beacon Credit Rating Agency, a domestic rating agency to rate the issuance of bonds in order to bring some confidence and comfort to investors. At the same time, in Kenya, the Capital Markets Authority has in place credit rating agencies guidelines in a bid to enhance best practices on the conduct of sovereign and corporate ratings in Kenya.

Despite the positive developments in Africa as far as development of a regional ACRA and domestic CRAs are concerned, it remains unclear whether financial independence in Africa devoid of Western influence can be achieved in the present global financial architecture. For example, Moody’s acquired a majority shareholding of 51% in Global Credit Rating (GCR) Co., a leading African-based rating agency, which also owns West Africa Rating Agency (WARA). Moody’s also has a significant stake in the Egypt-based Middle East Rating and Investors Service (MERIS). The acquisition of the GCR and WARA by Moody’s has significantly expanded the presence of the ‘big three’ international rating agencies in Africa, causing a huge setback for the development of alternative rating agencies to possibly compete against the monopoly.

On their end, CRAs argue that they are working strictly by the book when it comes to sub-Saharan Africa (SSA), and that the economic shock and the moratorium arrangements are proof of a weakened credit profile necessitating a rating downgrade, with Zambia’s and Mali’s defaults being cases in point. Fitch Ratings has also warned of a possible default by Ghana. However, Carlos Lopes, an Economist and Professor at the Mandela School of Public Governance at the University of Cape Town thinks differently. Lopes opines that:

The reality is that African countries are between a rock and a hard place. They don’t have the luxury to print their own money – as is happening in the West and more developed countries. As such they are limited in terms of their options to source liquidity. Notably, Africa risk perception cannot follow the same protocol as that of mature Western markets. Therefore, to grasp the local context and its particularities requires a constant local presence to build up a comprehensive picture. This is the first flaw of the CRAs’ approach to SSA. With practically no presence on the ground, this can only lead to at best a good ‘rough estimate’ of a country’s risk perception.

As a result, experts have called upon CRAs to address their African rating methodology by remodelling it to capture the essence of SSA risk. According to Alexandra Mousavizadeh, a former analyst at Moody’s,

Therefore, from the foregoing, what African leaders, policy-makers, academics, and other experts are calling for is not preferential treatment in favour of Africa but rather a fair assessment from international credit rating agencies. Preferential treatment is also not a bad option given the marginalisation of African countries in the global capital debt markets.