February 15, 2021

Today, an International Monetary Fund, (IMF), staff level agreement that will give the Kenyan government a three-year $ 2.4 billion financing package was announced. This package under the IMF's Extended Fund Facility and Extended Credit Facility now awaits Board Approval. In addition to supporting the Government of Kenya's COVID-19 response, the IMF said another important aim of the package was to support Kenya's "plans for a strong multi-year effort to stabilize and begin reducing debt levels relative to GDP."

As with many African countries, Kenya's precarious debt situation has been exposed by the COVID-19 crisis. Though alarm bells about the country's high debt levels had sounded earlier, it is during the pandemic that IMF declared Kenya at high risk of external debt distress.

After initially holding back, Kenya finally joined the G20 Debt Suspension initiative (DSSI) in order to defer some of its external debts payments, potentially up to $630 million, while committing to utilize the freed resources for crisis related spending. Some of Kenya's debt repayments to the Paris Club and China to the tune of $545 million falling due within the first half of 2021 have been delayed. Perhaps unsurprisingly, from April 2020, Kenya borrowed over 451 billion Kenya shillings from external sources, primarily multilateral creditors, to respond to the COVID-19 crisis.

But just how dire is Kenya's external debt situation? The Africa Sovereign Debt Justice Network has analyzed the data on Kenya's external debt burden indicators over the last decade. Although Kenya is at a high risk of overall debt distress, the focus of this blog post is the country's public external debt.

External Debt Stock and Composition

Throughout the decade, Kenya's external debt has been approximately half of its total debt stock. As of September 2020, Kenya's external public debt stood at 51.4% of its total debt stock of 7.1 trillion Kenya Shillings, a slight increase from 48.6% in 2011.

In 2020, the external debt composition was 39.3% for multilateral debt, 29.7% for bilateral debt, and 30.5% for commercial debt. This is a shift from 2019 when commercial debt (35.6%) surpassed multilateral debt (31.8%) and 2015 when bilateral debt (54.3%) exceeded both commercial (20.1%) and multilateral debt (29.4%).

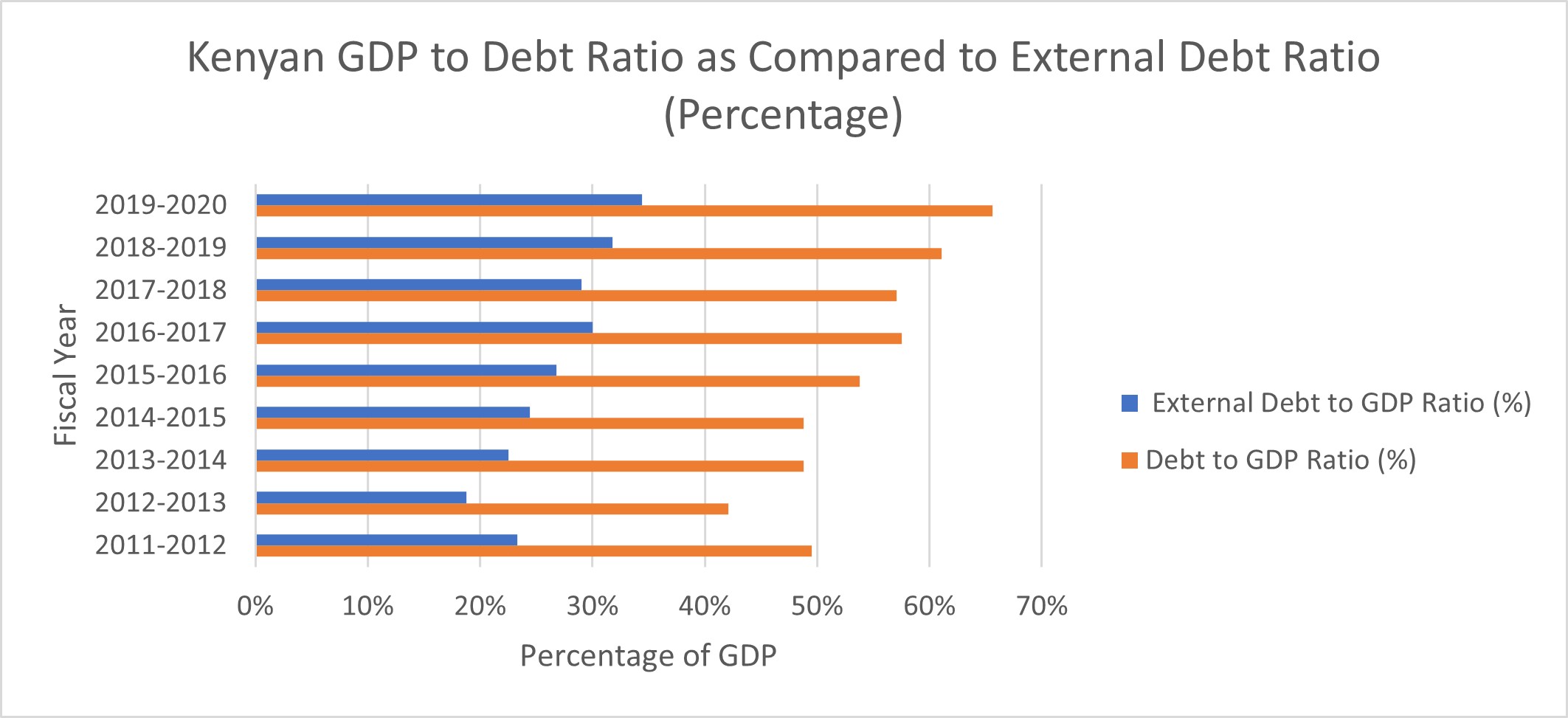

Debt to GDP Ratio and External Debt to GDP Ratio

Source: Kenya Annual Public Debt Management Reports

The graph above compares Kenya's total public debt and its external public debt as a proportion of its gross domestic product (GDP) over the past decade. Kenya's public debt increased by over 15 percentage points from 49.5% in 2012 to 65.6% of GDP in 2020. This ration encompasses Kenya's domestic and external debt.

Kenya's external debt also rose from 23.3% in 2011 to 34.4% of GDP in 2020. The external debt is below the World Bank and IMF indicative threshold of 55%, at which point the risk of debt distress would be heightened. However, it is concerning that Kenya's public debt is projected to increase to 69.9% of GDP by 2022, close to a branch of the 70% benchmark.

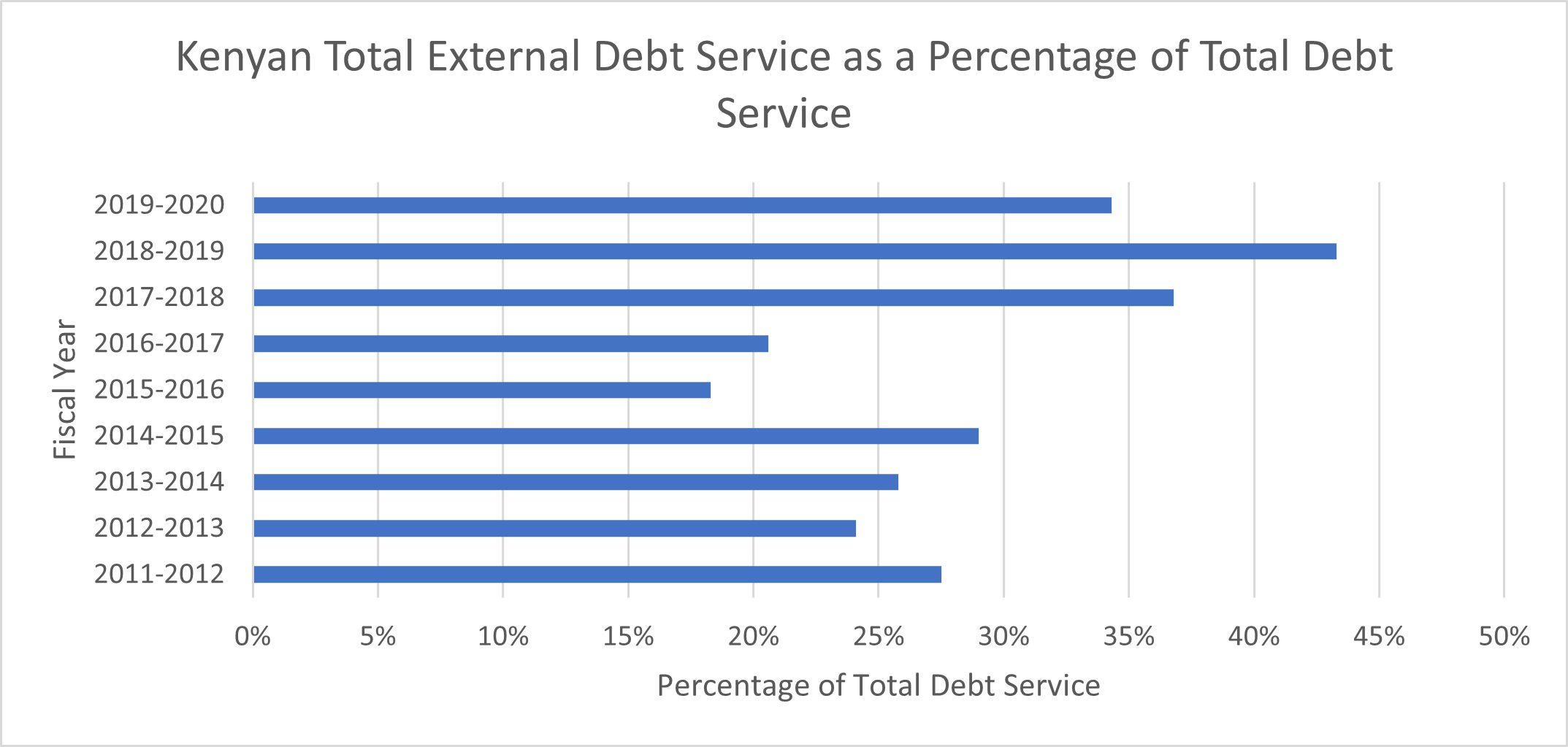

External Debt Service

Source: Kenya Annual Public Debt Management Reports

In effect, Kenya's total public debt service and external debt service have increased significantly over the last ten years. The proportion of Kenya's external debt service to its total debt service increased from an average of 25.8% between 2012-2014 to an average of 42% during the last three years of the decade. Between 2018-2020, commercial creditors received the bulk of Kenya's total external debt service payments, 54% in 2020, 76% in 2019, and 66.1% in 2018.

Public debt service rose seven-fold to 850 billion shillings in 2019 from 114 billion shillings in 2012. External debt service shot up even further by eleven-fold to 368 billion shillings from 31 billion shillings over the same period.

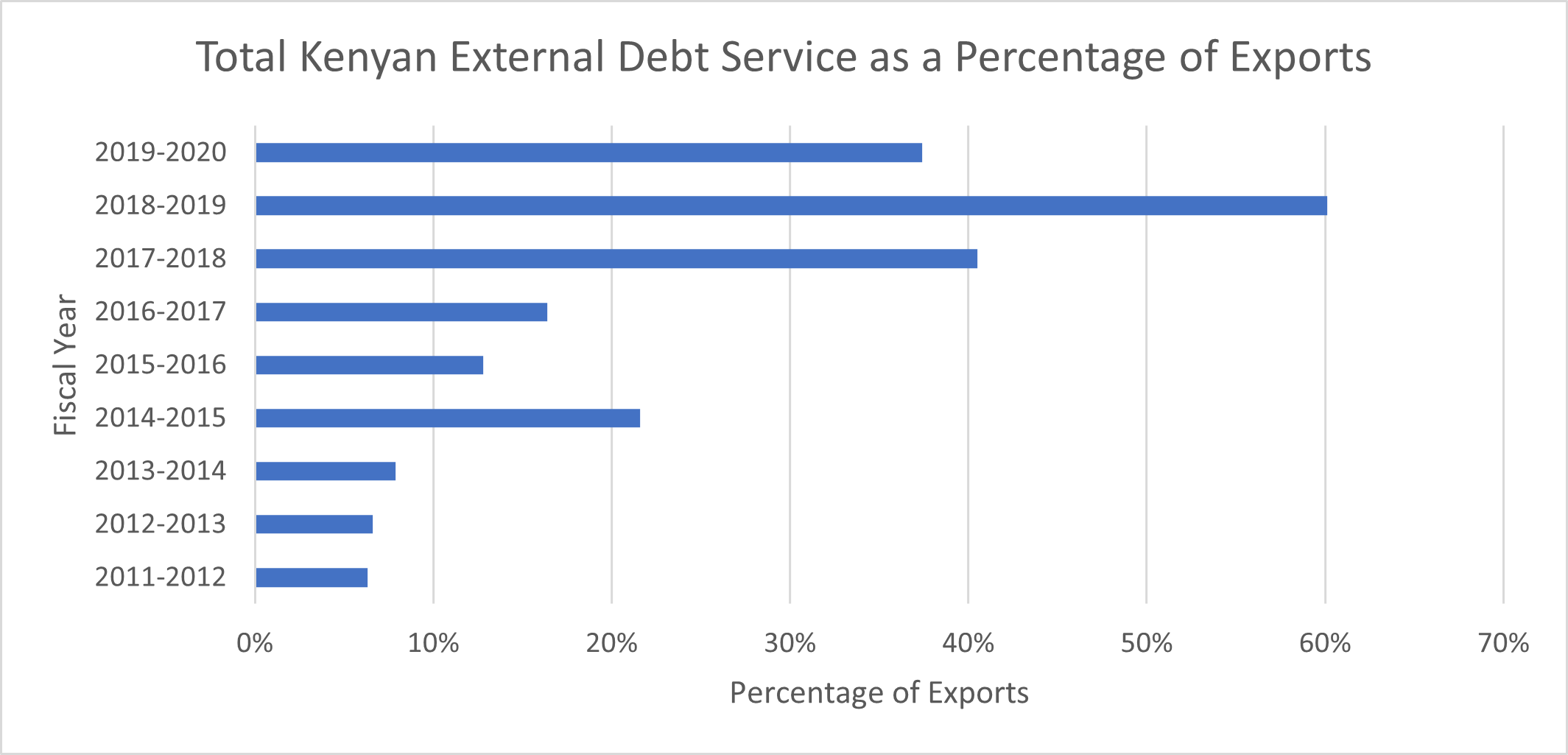

External Debt Service Payments to Export Ratio

Source: Kenya Annual Public Debt Management Reports

The graph above illustrates how much of Kenya's exports of goods was spent on servicing payments of its public external debt over the past decade. 60.1% of Kenya's exports was spent on debt service in 2019, a rapid surge from 6.3% in 2012. This pre-crisis increase, three times above the 21% IMF threshold, has been attributed to commercial debt servicing and plummeting export earnings. According to the Treasury, both Kenya's export earnings and revenues have fallen further as a result of the economic crisis caused by the COVID-19 pandemic.

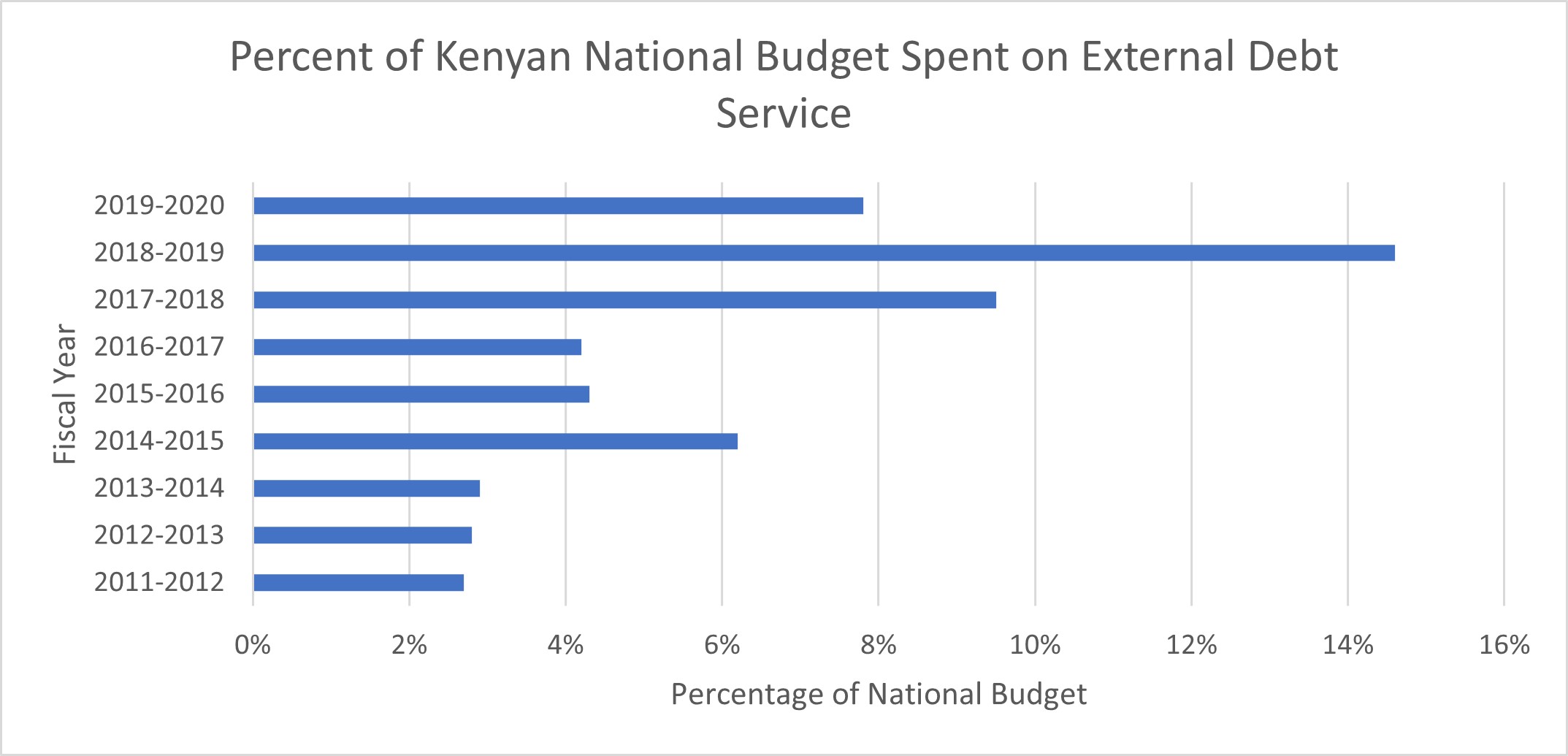

Proportion of National Budget Spent on External Debt Service

To reduce its external debt burden, Kenya proposes to undertake fiscal consolidation while prioritizing social spending and opt for concessional finance over commercial finance. Concerns have been raised about countries' pursuing austerity measures in the post crisis period which have historically translated to cuts on social spending.

This presents an even more difficult situation since Kenya's expenditure on external debt servicing exceeded its health spending in the pre-crisis period.

Source: Kenya Budget Statements and Kenya Annual Public Debt Management Reports

This graph shows the proportion of Kenya's national budget spent on servicing external debt over the past decade. In the first few years, the Kenyan government spent an average of 2,6% of its national budget on external debt payments. This notably increased six-fold to approximately 15% in 2019, more than the combined budgetary allocations to the country's health, agriculture and justice sectors that year.

Conclusions

There is still a lot that is unclear about Kenya's total indebtedness. For example, the National Treasury of Kenya is preparing to request Parliament to increase the upper limit of 9 trillion Kenya shillings (about 82 billion US Dollars). In addition, the rapid growth in interest payments on foreign debt have outstripped growth of exports increasing Kenya's indebtedness and inability to reduce its expanding fiscal deficit. Further, Kenya's Parliament has noted that the National Treasury of Kenya 2021 Budget Policy Statement has not fully complied with the disclosure requirements of the Public Finance Management Regulations particularly in Parts 26, 27, 28, 29, and 34 of that Statement. For Parliament to fully appraise the 2021 Budget Policy Statement, the National Treasury needs to make full disclosure as required by law. For example, the Budget Policy Statement does not disclose all contingent liabilities as well as pending bills as required by law.

Kenya's Public Finance Management Act prescribes the transparency requirements for borrowing that the government of Kenya is required to follow. In addition, Article 201 of the 2010 Constitution of Kenya that provides that openness and accountability, including public participation in financial matters is one of the key principles that should guide all aspects of public finance in Kenya. The disclosures on Kenya's sovereign debt indebtedness so far indicate that there could very well be examples of hidden debt - particularly sovereign debt that may not be publicly or dully disclosed particularly to Parliament. This together with Kenya's increasing indebtedness means that Kenya's Parliament and civil society groups like the African Sovereign Debt Justice Network and OKOA Uchumi must carefully scrutinize as well as the 2021 National Debt Management Strategy Paper and all the accompanying disclosures. Kenya's Parliamentary Budget Office has recently noted that increased interest payments on debt have reduced spending on development and recommended rescheduling of domestic debt.