October 13, 2023

IMF Quota Reforms: Is the appointment of a Third Executive Director for Sub-Saharan Africa a game changer?

Statement of the African Sovereign Debt Justice Network (AfSDJN) on the Occasion of the World Bank Group – IMF Annual Meetings, October 2023 Marrakech, Morocco

Africa is set to get a third seat on the Executive Board of the International Monetary Fund (IMF). This development was announced by Kristalina Georgieva, the Executive Director of the International Monetary Fund (IMF), ahead of the annual meetings of the World Bank and IMF in Marrakesh, Morocco, this week. The announcement comes amidst the ongoing 16th General Review of the IMF quotas set to be concluded in December 2023.

It is well known that African countries did not take part in designing the current international financial architecture, which was designed by Global North economies during colonialism. Almost eighty years since the establishment of the IMF and World Bank, the question of voice and representation of African countries in global economic decision making remains critical and cannot be divorced from the unfair governance structures of these institutions.

The IMF governance is based on quotas. Each member is assigned a quota in special drawing rights (SDRs), which is reflective of its “relative position in the world economy.” Quotas play a role in determining the financial contribution of each member country to the IMF as well as access to IMF loans (borrowing capacity). A key question is what do IMF quotas have to do with each member country’s voting power. The quota of each member determines its voting rights and consequently, its decision-making powers. Each member gets one vote per SDR 100,000 of their quota (quota based votes) in addition to basic votes (which are the same for all members). In other words, compared with the UN, which is a one member-one vote system, the stronger the economic power of a member, measured through its contribution of financial resources to the IMF, the greater its decision-making power and say in the running of the organization.

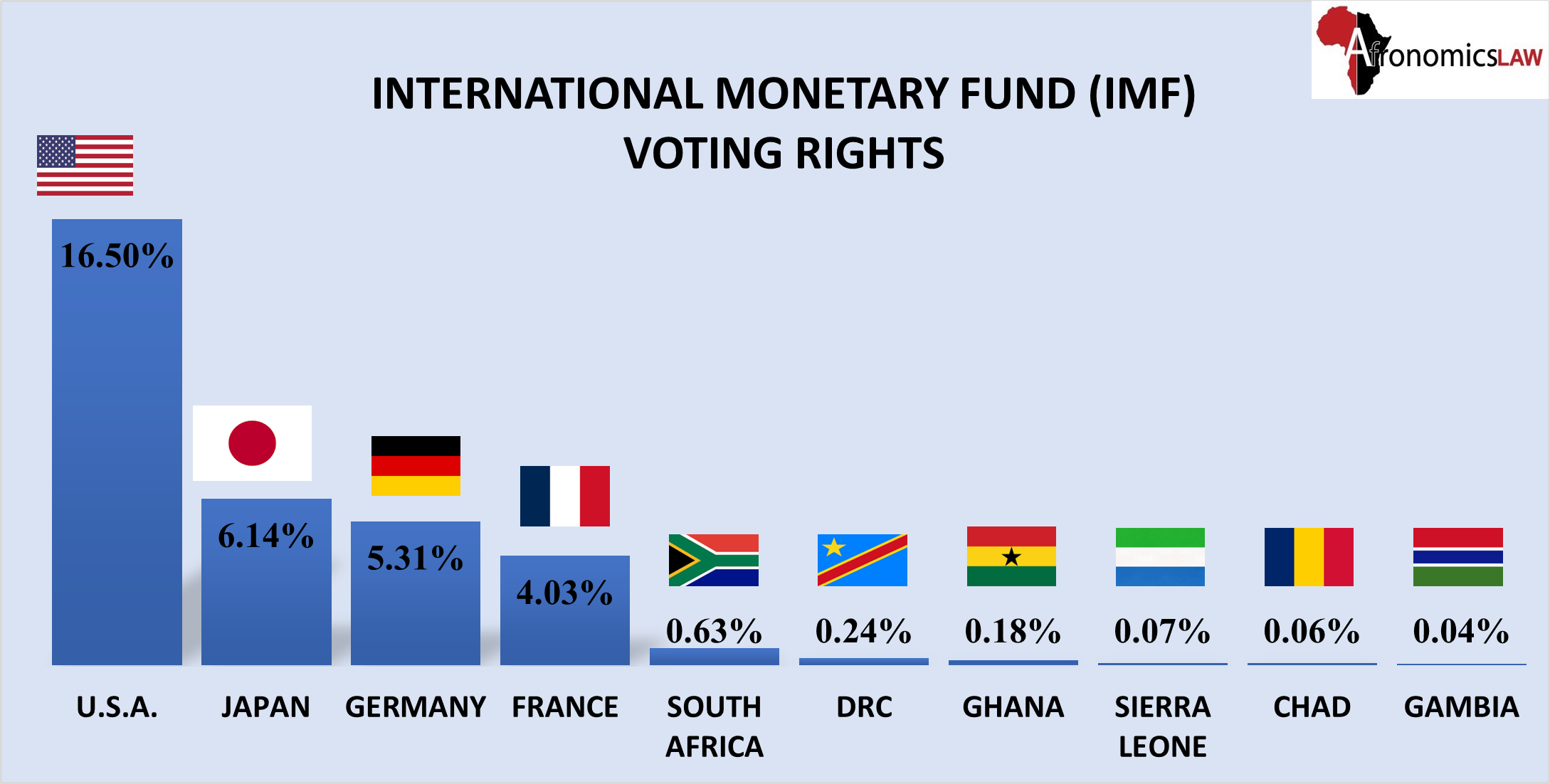

Amid ongoing calls for reform of the global financial architecture and a radical overhaul of the Bretton Woods Institutions by several global leaders, it is critical for the IMF governance structure to be more democratic, equitable and representative of African countries. Africa’s under-representation in the IMF is starkly demonstrated by its 6.47% voting rights despite a membership of 54 countries with a population of over a billion people. This is compared to the 16.5% voting power held by the United States alone. The proposal of one more Executive Director for Sub-Saharan Africa is hardly a cause for celebration. The region comprising 45 countries has been represented for the past few years by only two Executive Directors on an Executive Board comprising twenty-four members.

One additional Executive Director represents piecemeal efforts rather than substantial reform to give Africa more meaningful and equitable representation. First, while each Executive Director will now ideally represent 15 countries, in sharp contrast, several wealthy countries have a single Executive Director specifically representing their interests on the Executive Board. These include the U.S., Japan, China, Germany, France and the UK. Secondly, decision making is hinged on the voting power of IMF members (determined by their quota shares). These 45 African countries collectively hold a combined total of only 4.64% voting power, an absurdity that shows that more is needed in terms of quota reform than an additional Executive Director.

A Snapshot of IMF Voting Rights of Member Countries

Data compiled from the IMF website.

The ongoing IMF reforms are primarily focused on quota realignment and increase that would also protect the share of least developed countries in the IMF. However, the Secretary of the U.S. Treasury, Janet Yellen, has instead called for an “equi-proportional increase”, which would retain the U.S.’s dominance in the IMF. Previous quota reforms have recognised the increasing economic power of emerging economies such as Brazil, China, Russia and India. Since the last quota increase in 2016, there have been notable shifts in the economic weight of its members, which need to be reflected in the size of their quotas. While important, this cannot be the only focus of the Fund amid concerns about its legitimacy in the 21st Century, especially with respect to its low-income country members.

As the African Sovereign Debt Justice Network (AfSDJN) has previously stated, enhancement of the IMF quotas of low income countries to amplify their voice in its decision making regardless of their economic weight is the more meaningful option. The Fund plays a dominant role in shaping African economies through its lending and surveillance (typically requiring the adoption of harsh austerity measures), yet the region barely has any significant influence on decision making. Recent research has shown that 117 of 275 completed IMF loan programmes over the past 20 years were in Sub-Saharan Africa, compared to only 7 in advanced countries. African economies stand to be disadvantaged by a quota adjustment based primarily on economic weight. Even though the Fund pledges to ‘protect’ the quota of low income countries, this is insufficient to increase the say of African countries in the operations and policies of the IMF.

Beyond voting rights and decision-making powers, quotas play a key role in the allocation of special drawing rights (SDRs). As was observed from the 2021 $650 billion SDR allocation to respond to the economic crisis following the COVID-19 pandemic, African countries received only $34 billion (5% of the total allocation), while the greater proportion went to advanced countries which hold more IMF quota shares. The U.S. alone received $113 billion (17% of the total allocation), while European countries got $160 billion (25% of the total allocation). G20 countries pledged to channel $100 billion to low income countries primarily through the IMF Poverty Reduction and Growth Trust (PRGT) and the recent Resilient and Sustainability Trust (RST) – essentially more loans. Several African countries are already heavily indebted and are struggling to get their economies back on a sustainable path amidst global crises and climate disasters.

Simply put, “the global financial architecture is outdated, dysfunctional and unjust”, as the United Nations Secretary-General, António Guterres, stated in June this year. The AfSDJN reiterates that at a time when the legitimacy and credibility of the IMF in its relations with African countries is increasingly being called into question, the ongoing quota reform presents an opportunity to right the past wrongs and commit to genuine inclusion and meaningful participation of Africans in the institution. Short of this, African countries will continue to play catch up in a rigged game.