January 10, 2022

Introduction

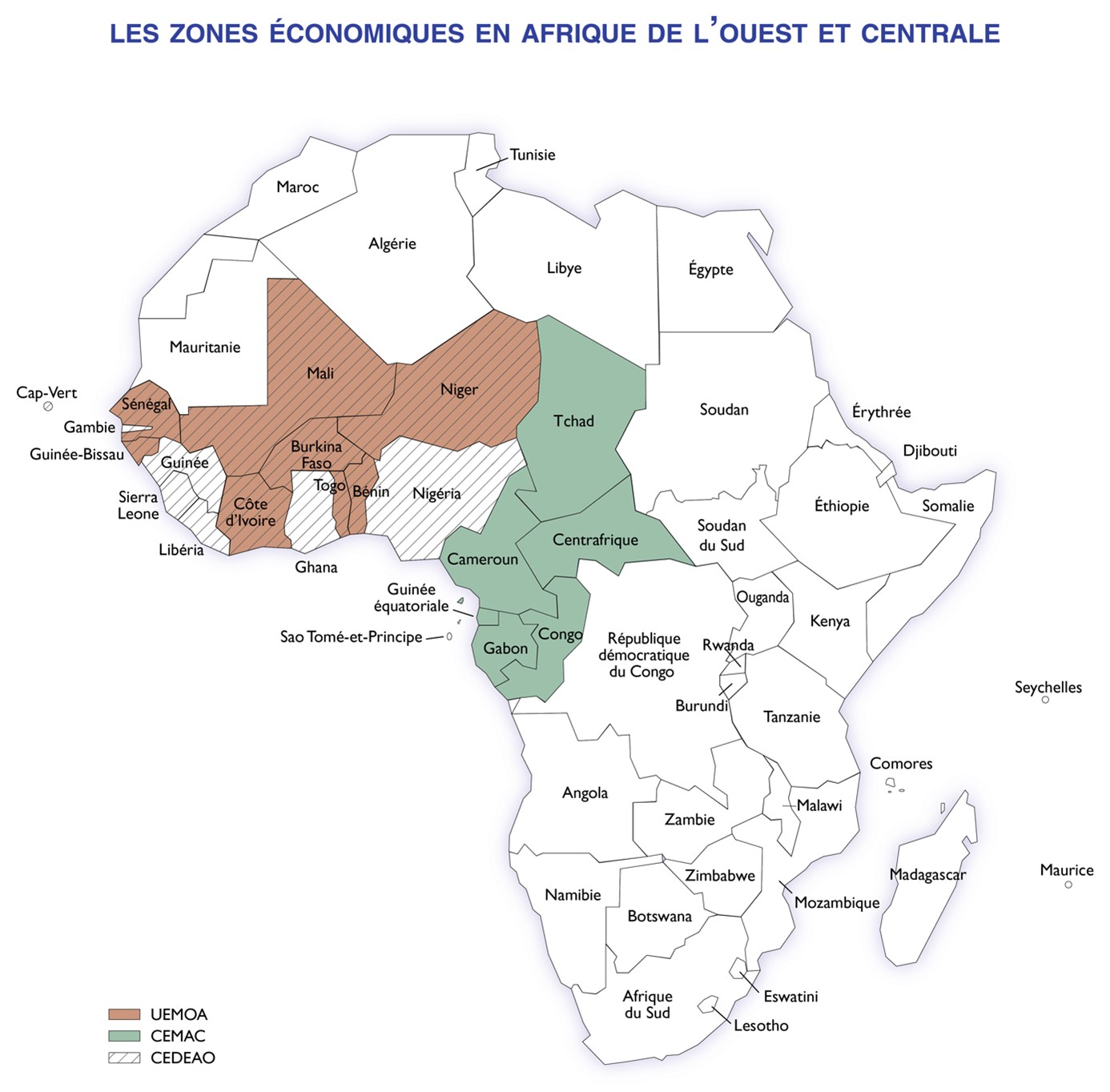

On 21 December 2019, the French President Emmanuel Macron and the Ivoirian President Alassane Ouattara announced a “reform” of the monetary cooperation relations between France and the West African Economic and Monetary Union (UEMOA). This reform comes with a transformation of the CFA Franc and takes place in the context of a single currency project of the Economic Community of West African States (ECOWAS). The CFA Franc zone currently comprises of 14 sub-Saharan African countries belonging to two currency unions. [1] Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo are members of the West African Economic and Monetary Union (UEMOA),[2] established in 1994 on the foundations of the West African Monetary Union, itself created in 1973. The other six countries - Cameroon, the Central African Republic, the Republic of the Congo, Gabon, Equatorial Guinea and Chad - are members of the Economic and Monetary Community of Central Africa (CEMAC). These two unions use the same currency, the CFA Franc, which stands for Communauté Financière Africaine (“African Financial Community”) in UEMOA and Coopération financière en Afrique centrale (“Financial Cooperation in Central Africa”) in CEMAC. Apart from Equatorial Guinea (Spanish) and Guinea Bissau (Portuguese), the other 12 countries have been French colonies (de facto or de jure).[3] The CFA Franc is issued by the Central Bank of West African States (BCEAO) (for West Africa) and the Bank of Central African States (BEAC) (for Central Africa). Each of these currencies is legal tender only within its own region, thus not directly interchangeable.

© Banque de France

In his Theory of Economic Integration, Bela Balassa conceived five stages of economic integration: (i) free trade area, (ii) customs union, (iii) common market, (iv) economic union, and (v) complete economic integration. In Balassa’s degrees of economic integration, the fifth stage entails, among others, the “unification of monetary, fiscal, social, and countercyclical policies” as well as the establishment of a supranational authority whose decisions are binding for the member states. In Balassa’s theory, monetary unions form part of the fifth and last phase of economic integration. Yet, the history of the monetary construction around the CFA franc differs from the experiences observed elsewhere including in the European Union. In reverse to the Balassa’s stages, the CFA Zone started with a common currency then, fifteen years later, the two banks (BCEAO and BEAC) and finally, the creation of the regional trade blocs in west and central Africa (UEMOA and CEMAC).

It is true that this description of stages is only theoretical and the sequential process not a rigid phenomenon. Likewise, the creation of monetary unions in international law somewhat precedes Balassa’s thesis, although, in the majority of instances, currency or monetary unions were established to accompany the process of economic integration. It is for instance the case of the German Zollverein created in 1834, which, immediately after its formation, saw the need of a common currency, thus giving rise to the 1838 Dresden Coinage Convention which paved the way to the Vienna Monetary Treaty in 1857 when Austria and Liechtenstein associated with the Zollverein states. The 1865 Latin Monetary Union between France, Belgium, Italy and Switzerland (joined by Greece two years later) was another, though unsuccessful attempt, to fashion a common monetary policy and a common currency in Europe. The common denominator between these early attempts was the sovereign choice of participants to commonly exercise monetary powers each time on the basis of an international agreement. While the creation of the European common currency (Euro) in 1999 brought back monetary unions to the centre of debates and studies, in particular thanks to the magnitude of the project, these forms of union, as mentioned, are far more ancient.

From the above, the formation of monetary unions presupposes the autonomous choice of countries that accept to surrender their sovereignty in monetary policies to a supranational agent. This is often done to lower the costs related to cross-border trade in a bid to accelerate the process of economic integration among the participants. These low-transaction-costs advantages of a common currency in a region, which also imply abandoning the exchange rate between the participating countries, were described by Robert Mundell in his 1961 article on optimum currency areas. However, the assumption of states’ autonomy to form or join a monetary union hardly applies to the CFA Franc zone because, as will be addressed in this symposium, the currency was created by France. The fact that France is at the initiative to reform the CFA Franc therefore came as no surprise for anyone familiar with the nature and functioning of the currency. In the same vein, studies find that the CFA Franc zone does not meet the requirements of an optimum currency area. While not meeting several criteria of an optimum currency – such as the countries’ structural difference that subject them to asymmetrical shocks – some maintain that the CFA Franc has at least been sustainable. They argue that “despite significant events that could call it into question such as political independencies in the 1960s, the strong devaluation of the CFA franc in 1994 or the launch of the single currency in Europe”, the CFA Franc monetary agreement withstood the test of time.

The Necessity for Reform amid a Growing Francophobia

The CFA Franc is considered as one of the last relics of French colonial legacy in Africa and the living symbol of the so-called “Françafrique”. The “Françafrique” is a term coined by the French economist François Xavier Verschave to describe the “special relationship” between France and its ex-colonies decades after independence, or as international relations theorists call it, “France’s sphere of influence”. It was derived from the expression “France-Afrique” allegedly used for the first time in 1955 by Felix Houphouet-Boigny, then Member of the French parliament (who later became the first President of Cote d’Ivoire), to capture the close and amicable ties between his country and France. However, far from encapsulating the desire of some African leaders such as Houphouet-Boigny to maintain privileged and close relations with France after the accession of their country to independence, the expression Françafrique as used by Verschave and thereafter rather depicts the underlying neo-colonial character of that relationship epitomised by corruption, coups, support to autocratic regimes, clandestine financing of French political parties through official public aid allocated African states, exploitation of natural resources, etc.

At the origins of the Françafrrique is the creation by General De Gaulle of an African Affairs Unit at the Elysée presidential palace and headed by Jacques Foccart, also fondly known as “Monsieur Afrique” (“Mr. Africa”). The system put in place by Foccart was based on an implicit deal backed by clientelism and blackmail. The former French colonies would maintain a special link with France while the latter would guarantee them security. In exchange for that security, these so-called “friends of France” would form a club of countries loyal to their former colonial master to whom they ensure privileged access to their raw materials. The Foccart network was also responsible for the replication of the “elites” who occupied positions in the French administration during colonialism and were the ones leading their countries upon gaining independence, a situation reminiscent of Giuseppe Lampedusa’s oft-quoted words that “if we want things to stay the way they are, things will have to change”. The case of Houphouet-Boigny is a perfect illustration of these things that changed so that nothing changed. The reform of the CFA Franc may not be any different in that regard as Lionel Zevounou argues in this symposium.

This reform also comes at a time when the anti-French sentiment has reached its height in francophone Africa. Francophobic sentiment is mainly characterised by protests against French military presence and an increasing vocal anti-CFA Franc campaign. For instance, when in 2017 a Senegalese court acquitted a controversial activist Kemi Seba who was facing charges of destruction of property of the BCEAO after publicly burning a CFA Franc banknote, most of the young Africans believed that Seba’s actions were legitimate. As reported, protesters believed that “the act of torching of the note was like when Nelson Mandela, the anti-apartheid leader, burnt his pass book in protest against Apartheid laws”. In 2018, ten musicians from seven African countries released a song titled “7 minutes contre le CFA” (“7 minutes against the CFA Franc”) in which they join the criticism of the CFA as a colonial currency and an affront to African countries’ sovereignty. The decision to finally engage on the reform of the CFA Franc could therefore be commanded by a desire to appease that growing anti-French sentiment.

The reform, which purports to put an end to the CFA Franc (as denomination) and replace it with the ECO, was officially endorsed by the French parliament on 20 May 2020. This renaming – seen by some as a mere cosmetic change, and by others as an opportunity for a structural reform – does not disengage France entirely since it is poised to remain the “financial guarantor” of the West African Monetary Union (WAMU). The reform certainly takes the debate on this currency a step forward. The CFA Franc disappearance altogether is an increasingly strong desire in the Franc zone. While many proposals along this line have been developed for years, as mentioned, no concrete steps were taken by the political leaders to implement that desire of monetary sedition. In the eyes of many analysts, the CFA Franc suffers from a three-prong ailment: it is a colonial, servile and predatory currency.

The CFA Franc as a Controversial and an Ever-Contested Currency

The CFA immediately became controversial in postcolonial Africa because it was portrayed as an obstacle to development. For the critics, the CFA Franc was not designed to expressly allow the competitiveness of the economy of the countries that use. This is because the economy of these countries was to be confined exclusively to the role of supplier of raw materials to France that was responsible for exporting or transforming them. Consequently, the countries of the Franc Zone started criticizing the nature of the ideology behind the CFA because it deprived them of monetary power which is synonymous with real independence.

Stories and narratives relating to the CFA Franc could, on closer look, resemble that of a sea serpent. Anecdotes, conspiracy theories, and thorough documented historical accounts are legion. For instance, some have argued that one of the first unconstitutional seizure of power in the post-independent Africa is linked to the issue of the CFA Franc. In fact, on 13 January 1963, only two days after having started to print Togo’s own currency thus severing ties with the CFA Franc, Sylvanus Olympio was killed in a coup. He had only been in office for three years as Head of State of the newly independent Togo. In a similar vein, others hold the view that Modibo Keita of Mali was equally ousted in a coup in 1968 six years after having withdrawn his country from the CFA Franc. The Malian franc created in 1962 by Modibo Keita (who died in a prison in 1977) remained the country’s currency until 1 July 1984. The Cameroonian economist Tchundjang Pouemi who also militated in favour of the abolition of the CFA Franc (along others such as the Egyptian Samir Amin), was found dead allegedly because of his anti-CFA Franc opinions. Indeed, Tchundjang Pouemi was one of the pioneers of the post-colonial criticisms against the CFA Franc as a French currency in disguise. It is worth recalling that General de Gaulle created the franc of the French colonies in Africa (CFA) on 25 December 1945, to reaffirm his country’s control over its colonies at the end of the second world war. In his now-celebrated magnum opus, Monnaie, Servitude et Liberté published in 1980, Pouemi aptly described the colonial legacy of the currency as follows: “La France est, en effet, le seul pays du monde à avoir réussi l’extraordinaire exploit de faire circuler sa monnaie, et rien que sa monnaie, dans des pays politiquement libres” (transl.: “France is, indeed, the only country in the world to have achieved the extraordinary feat of circulating its currency, and nothing but its currency, in politically free countries”). Since 1945, there have been some cosmetic changes to the denomination, none of which has reduced the tutelage of France over its colonies in monetary matters. This symposium sets out to address some of these concerns and whether the “new” ECO is any different.

These facts, anecdotes and sometimes unverifiable tales depicting the risk associated with the CFA Franc, not only for the economic development of the countries that use it, but also to the life of those who dared criticizing it, may have explained why the question remained a taboo for quite some time. However, with the publications of books such as that of the Ivorian Professor Nicolas Agbohou, the debate about the CFA Franc has regained attention in the literature. Since then, dozens of other books and articles have been published on this issue. One can cite examples such as the edited collection by Nubukpo et al. (2016), in which authors propose solutions to get African countries that use the currency out of monetary bondage; the book of Pigeaud & Samba Sylla (2018) and the English version published in 2021, in which the authors dissect the CFA system as “Africa’s last colonial currency”. Two of these critiques (Kako Nubukpo and Dembe Moussa Dembele) also present their views in this symposium.

From “Nazi” Origins to “Françafrique”

Professor Nicolas Agbohou in his book argues that France under German occupation was victim of what he termed “nazisme monétaire” (“monetary Nazism”). Agbohou sheds light on the often ignored and infamous legacy of the Nazi Germany, which he depicts as the ancestor the CFA Franc system. In fact, the German occupation of France did not only result in a spectacular plunder and blood shedding, but also constituted the terrain for the execution of monetary Nazism. It was in May 1941 that Germany installed its own commissioners at the Banque de France as well as at all strategic financial positions in the vassalized French country. Because it was the largest of the territories conquered by Germany, France suffered the German monetary Nazism more acutely than Belgium and Poland, the other territories also under occupation. Writing in 1945, René Sédillot described the pernicious mechanism as follows: “over the centuries, the forms of plunder have become more skilful. The ancient Germans simply devastated the countries they had conquered. Their descendants, in 1940, resorted to a more subtle and more fruitful method of plunder: they put the mark at 20 francs.” (transl.)

Upon its liberation in 1945, France replicated the same monetary system in Africa with the creation of the CFA Franc in the aftermath of the Bretton Woods Agreements. That is why, with a degree of exaggeration, Professor Agbohou considers Hitler not just as the “father” of the German monetary Nazism but also as the “grand-father” of the CFA Franc. More than 75 years after its creation, the CFA Franc remains one of the most obstinate vestiges of colonization.

Despite merits in Agbohou’s arguments, it is important to note that the creation of the “Franc Zone” is a bit older and predates France under Nazi occupation. Indeed, several France’s decrees at the beginning of World War II already referred to the “Franc Zone”. The main objective of those decrees, including that of 9 September 1939 relating to wartime foreign exchange control, is to protect the French economy from the instabilities due to the Second World War especially capital flight. Those strict exchange controls and the inconvertibility of the franc are not only on mainland France, but also on its overseas departments and its African and Asian colonies. According to the Banque de France, this is how the Franc Zone was born, even though the CFA Franc as a colonial currency was only created a couple of years later.

While its critics believe that the time to put it in the antiques museum and start a new path is long overdue, others believe that African countries that use it are not yet ready, thus should wait. The imperative to break away from this neo-colonial system and recover the indispensable monetary sovereignty without which there can be no development is at the centre of this symposium. Whether the recent announcement of reform would mark a decisive step towards the dismantling of the Franc Zone and the disappearance of the CFA franc remains to be seen.

The Contributions

The CFA is accused of representing an instrument of political and economic repression in the hands of France and of constituting an impediment to the development African countries that use it. The proposed reform comes with two nonnegligible important technical transformations. The first is the end of the operations account held by the French treasury. In order words, WAMU states will no longer be required to deposit half of their foreign exchange reserves with the Banque de France. The second is the departure of the French Administrator from the Central Bank of West African States. The Minister of Finance and the Governor of the Banque de France have so far participated in the two annual meetings, one of which was held in Paris.

Nevertheless, these changes have at varying degrees been perceived as merely symbolic, or as smokes and mirrors. This perception is a shared by most contributors to this symposium. Alexandra Esmel first takes the reader through the genesis of the monetary cooperation agreement between France and west African countries and discusses how it functions. She explains the four guiding principles of the cooperation agreement. Addressing the change of the name of the currency from CFA Franc to Eco, Esmel argues that nowhere in the 2019 Agreement does one find the new name “Eco”, which, to her, implies that the change of name is far from being the object of the new monetary cooperation agreement. Esmel finds other purported changes that are merely decorative. This may therefore mean that the end of the CFA Franc is just wishful thinking.

Lionel Zevounou emphasises that “tout change pour que rien ne change” (“everything changes so that nothing changes”). Like Esmel, Zevounou holds the view that the purported changes are not structural enough. But Zevounou takes his legal analysis further to question the essence of sovereignty underpinning the “negotiations” of the monetary cooperation agreements between a colonizer and a former colony. Zevounou illustrates his arguments with a Benin Constitutional Court’s case where an applicant sought to challenge the constitutionality of the Franc Zone because it functions, according to the applicant, against the interest of Benin. That Constitutional Court ruling raises issues beyond the CFA Franc agreements and touches upon issues such as self-determination and sovereignty as employed in international law and Zevounou critically engages with these issues, thus going beyond what he calls the usual “external” critiques of the CFA Franc system.

It is however important to mention that while the CFA Franc is far from a perfect currency, is not the origin of all the evils of the continent. So, it would be ideal that any change/reform to the functioning of the currency is driven by the representatives of the CFA Franc zone’s States and specialists on the matter. This lack of consultations with the stakeholders is what drives Demba Moussa Dembele to question the sincerity of what he calls the Macron-Ouattara project. In his post, Moussa Dembele is sure and certain that France is seeking with this new agreement to sabotage the ECOWAS single currency project with the complicity of some UEMOA leaders. According to him, France is not only courting French speaking countries in the region to maintain its tutelage over its former colonies but also seeking to enrol some English-speaking countries such as Ghana to give more “credibility” if not a certain “legitimacy” to its venture. This thought-out strategy, according to the author, ultimately intends to isolate Nigeria’s leadership and prevent or delay the maturation of the ECOWAS single currency’s project.

Iwa Salami explores some legal and policy considerations related to the West African Economic and Monetary Union’s exit from the CFA Franc Zone. While noting the opportunity that this reform offers to WAEMU to channel the funds initially contributed to the foreign reserve in France to structural transformation in the region nevertheless exhorts WAEMU countries to work on achieving monetary and price stability during the Covid-19 pandemic. This is important to contemplate a monetary union that expands to other ECOWAS countries and eventually contributes to the realisation of the pan-African monetary union.

The symposium closes with the contribution of Kako Nubukpo. Besides pressure that should be accentuated on decision makers for a real reform of the CFA Franc, Nubukpo offers four technical options that can ensure a gradual transition from the CFA Franc to an Eco of 15 countries within the ECOWAS bloc. Not that he believes in the reform that has been announced. Rather, his arguments are based on a Togolese proverb that if someone “pretends to die, you have to pretend to burry” him. In other words, if France pretends to reform the CFA Franc, the funerals of the CFA Franc should be organised, and these proposals aim at putting more pressure on African decision makers who can no longer pretend that their taciturnity results in a lack of pertinent ideas.

Contributors’ bio

Demba Moussa Dembele is an economist, President of the African Research Association in Support of Endogenous Development (ARCADE) based in Dakar, Senegal.

Alexandra Esmel works in New York with Emery Mukendi Wafwana & Associates P.C, an International African Law firm on African-related matters of International Economic Law.

Kako Nubukpo is an economist currently the Commissioner at the Department of Food Security, Agriculture, Mines and Environment at the West African Economic and Monetary Union. He is a former Togolese minister and full professor of economics and Dean of the Faculty of Economics and Management, University of Lomé (Togo).

Iwa Salami is Reader in Financial Law and Regulation at the University of East London.

Lionel Zevounou is Maître de Conférences in Public Law at the University Paris Nanterre.

[1] It bears noting that while Comoros is part of the Franc zone, it does not use the CFA Franc but the Comorian Franc.

[2] While the English acronym is WAEMU, I will throughout this piece stick to the French acronym UEMOA.

[3] While Cameroon and Togo were not strictly speaking "colonized" by France, they were administered as League of Nations mandated territories after Germany's defeat during WW1 (and were later placed under the United Nations International Trusteeship System). Cameroon, which was partitioned and administered by the British and French, obtained its independence from France in 1960 and Great Britain in 1961 respectively. Considering the current anglophone crisis in Cameroon, this may appear as an oversimplified account of Cameroon's colonial history. However, this is not a matter worth addressing in this symposium. Togo, the other German colony, was also administered by the French and the British (but unlike British Cameroons, part of which voted to join either French Cameroon or Nigeria, the British Togoland chose to join Ghana).

[4] See Joseph Tchungjang Pouemi, Monnaie, servitude et liberte: La repression monetaire de l'Afrique (Menaibuc, 1979), at 27.