May 21, 2020

Introduction

Coronavirus disease of 2019 (COVID -19), which was first detected in Wuhan, China, has become a global nightmare. The pandemic has mercilessly and hardly hit the entire world indiscriminately. The total number of coronavirus infections and deaths as at May 20, 2020 were 4.97 million and 327,000 respectively. Each part of the world is grappling to contain it.

Owing to the uncertainties as to when it will end, lack of vaccination to prevent it, and medication to cure it, it has created fear and panic, which have severely disrupted supply chains and drastically slowed down economies and financial markets. As statistics is already showing, COVID -19 is likely to continue spreading rapidly and cause strain on the health facilities and severe illness and deaths to the communities. There have been more worries about the possible dreadful effects of this virus when it reaches the global south that has a majority of states characterised by poverty, existing pandemic burdens, overpopulated cities, and overstretched health systems.

This essay focuses on the contribution of the African Development Bank in the fight against COVID-19 using innovative financing solutions. It further supports the need to capitalise on such funding solutions to finance the much needed development in the continent.

On a global perspective, Africa is often problematically depicted by the Western media through the sole lens of backwardness associated with poverty, pandemic diseases, poor sanitation, hunger, civil wars, overpopulation, and the poorest health system in the world. It is indeed paradoxical as the continent has 25% of the world’s most fertile land, 10% of the global renewable water resources, world’s youngest population to provide enough labour force, and 30% of earth’s natural mineral reserves that include 70% of platinum, 40% of gold, and 60% of cobalt deposits among others. From the extent of burden that the scourge is placing on the developed economies such as the EU and the US despite their strong health infrastructure challenging their readiness to respond to disasters, it was recognised that Africa had no capacity to deal with it on its own. However, since Africa seemed to be spared over the first one and half months of disease emergence, it had some time to learn from the US, Europe, and Asian nations about the responses that were working.

Ideally, as one of the global public goods, COVID -19 is of critical importance that calls for mutually beneficial, new, and sustainable global and regional engagements necessary to eliminate it. However, the global response to this pandemic in Africa has so far been lacking. In fact, this situation is unlikely to change as every region is struggling to manage its own COVID-19 emergencies.

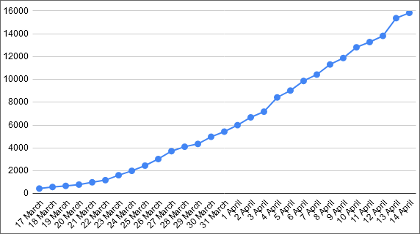

Although the onset of coronavirus in Africa was slow, there were concerns that its infection rates were rapidly increasing in the continent since the first case was detected on 14th February, 2020 in Egypt. Two months down, as at 14th April, 2020, as shown in figure 2, Africa had 15,831 confirmed coronavirus cases and 840 deaths. In the first teleconference of the Bureau of the Assembly of the African Union Heads of State and Government held on 26th March, 2020, to discuss the need for the content to have a coordinated response to curb the spread of this virus, the Bureau called upon the International Monetary Fund, World Bank, African Development Bank, and other regional institutions to use all instruments at their disposal to assist in combating this pandemic and offer relief to the crucial economies and communities in Africa.

Figure. 1 Confirmed COVID-19 cases in Africa. Source: African Arguments

Innovative Financing -“Fight Covid-19” Social Bond

As the African premier development finance institution mandated to spur sustainable socioeconomic progress across the continent, the African Development Bank (AfDB) has been actively involved in the fight against this pandemic. For instance, it approved $2 million emergency assistance to finance measures led by WHO to arrest COVID-19 in Africa, unveiled $10 billion as a response facility to fast-track member states’ efforts to contain the rapid spread of coronavirus, and issued a record-breaking $3 billion social bond. The AfDB’s “Fight Covid-19” social bond was issued on 3rd April, 2020, on London Stock Exchange’s Sustainable Bond Market to alleviate the economic and social impacts of coronavirus of 2019 on Africa’s livelihoods and economies. It is a three-year maturity bond that will pay an interest rate of 0.75%. The raised finances offer flexible responses towards lessening economic and social sufferings of regional member countries and the private sector as a result of this pandemic.

This offering is unique as it is: the first AfDB’s bond on London Stock Exchange largest dollar denominated; and largest dollar denominated social bond ever to be launched in international capital markets. This bond attracted investors from various parts of the world and different institutions. In terms of institutional investors, the final allocations were: 53% for central banks and official institutions, 27% for bank treasuries, and 20% for asset managers including environmental, social and governance (ESG) investors. Regional-wise distribution were: Europe (37%), Americas (36%), Asia (17%) Africa (8%), and Middle-East (1%).

Analysing AfDB in the Context of Environmental, Social, and Governance (ESG) Investing Framework

In the contemporary investment arena, investors are not only influenced by financial returns when making decisions on where to commit their dollars, but also consider the impact of their investments on promoting global issues such as pollution and climate change. Closely linked to socially responsible investing (SRI), ESG has gained a remarkable rise and relevance in the investment field. Besides, a focus on the traditional financial analysis, ESG integrates a wide spectrum of issues that aid in the identification of material risks and growth opportunities, which are of financial importance.

Investors use the environmental component to assess entity’s stewardship of environment. In other words, an investor focuses on the organisation’s impact on the earth, with one having a positive impact carrying the day. The considered issues include greenhouse gas emissions goals, climate change policies, water use and conservancy, carbon footprint and intensity, biodiversity, renewable energy generation and use, deforestation, promotion of green products and technologies, and recycling and safe disposal practices among others.

With regards to the social element, the analysis looks at the organisation’s focus on people and relationships. Some of the elements considered by ESG investors in their investment decisions include employee engagement, gender and diversity, community relations, conflict resolution mechanisms, customer satisfaction, consumer friendliness, employee training and development, employee treatment in terms of pay and benefits, health and safety, working conditions and labour standards, and human rights and social justice.

The AfDB is committed to financing environmental and social programs as it believes that they support economic growth and poverty reduction efforts across its member states. It has adopted an integrated safeguards system (ISS) to ensure environmental and social sustainability of its investments. The ISS has four components that include:

- The integrated safeguards policy statement

- 5 operational safeguards (OS)

- The environmental and social assessment procedures (ESAP)

- The integrated environmental and social impact assessment (ESIA)

These components promote best practices to address social and environmental challenges in the continent. They aid in the identification of risks, reduction of development costs, improvement of project sustainability, and promotion of greater transparency and accountability.

The governance element looks at the standards for running an entity. ESG investors analyse how an organisation is run, how its management and board associate with different stakeholders, and whether its incentives align with the success of the business. In terms of governance, the AfDB performs very well as racked by the 2018 Global Aid Transparency Index. It improved its position by 6 points to position 4 out of 45 development financial organizations, just behind the World Bank, the African Development Bank, and the Inter-American Development Bank. This improvement shows the AfDB’s improvement in operational capabilities and strict abidance to best-in-class reporting and disclosures. It is committed to share transparent and open data on the impact of projects, results, and evaluations. It is also an indication that reporting and publication of all aid and development associated activities is proactive, comprehensive, accurate, and timely. In terms of credit ratings, the AfDB is triple-AAA rated by the major rating agencies Moody’s, Standard & Poor’s, Fitch, and the Japanese Credit Rating Agency. Such high ratings show the AfDB’s strong membership support, strong financial strength, and prudent financial management and liquidity policies. Additionally, as noted earlier, the AfDB has an ISS that among other functions encourages greater transparency and accountability.

Focusing on ESG Investors to Address Developmental Financing Gaps

Realising that Africa persistently faces structural challenges of current fiscal deficits and debt vulnerability, the AfDB joined the Socially Responsible Investment (SRI) markets in 2017 and introduced social bond framework and in November, it issued its first EUR500 million 7-year social bond. In total it had made issuances equivalent to $5 billion denominated in Euro, Norwegian krone, and US dollars.

The social bond program has been widely accepted by various parties including the ESG investors as was recently witnessed by bids for the “Fight Covid-19” social bond exceeding $4.6 billion. As shown under the foregoing section, AfDB has positioned itself as a socially responsible investing conscious entity, thereby blending well with a majority of ESG conscious. Besides the warm welcome of its social and green bonds, the AfDB was recognised at the Global Capital SRI Awards held in September 2018 in Amsterdam. It was ranked second as the most impressive sustainability bond issuer entity.

Capitalising on its widespread positive repute, the AfDB should issue more social bonds to finance the funding gaps experienced in the continent, especially now that the economies are projected to head to recession due to the effects of COVID-19 pandemic. As its President Akinwumi Adesina notes, COVID-19 will cost the continent a gross domestic product (GDP) loss between $22.1 billion, in the base case scenario, and $88.3 billion in the worst case scenario. Also, the shock resulting from COVID-19 is expected to squeeze fiscal space in Africa as deficits are projected to increase by 3.5 - 4.9%, raising Africa's financing gap by an additional $110 - $154 billion in 2020. Additionally, the public debt is estimated to rise from $1.86 trillion at the end of 2019 to over $2.1 trillion in 2020 if the pandemic persists.

Also, Africa has been experiencing an annual SDG funding gap of $1.3 trillion (it only manages to fund 13%). The Bank also needs resources to finance its High 5s priorities for African transformation, which by extension will aid in the attainment of the UN SDGs and African Union 2063 Agenda. In a nutshell, financial institutions should focus on the positive opportunities and learning experiences from this pandemic and plan how they will help their member states adjust to the effects of COVID-19 and attain sustainable development thereafter. This step will be in line with the World Bank’s advice on planning for the economic recovery from COVID-19, in the bid for nations to restart their economic engines and build back stronger and better in the short term and longer term.