Stand-Alone Posts

The Coordination of the Foreign Policies of the Member States of CARICOM: A Contemporary Reappraisal

October 7, 2021

The Diplomatic Academy of the Caribbean of the University of the West Indies presents an online Webinar themed "The Coordination of the Foreign Policies of the Member States of CARICOM: A Contemporary Reappraisal".

It is tailored for those interested in acquiring substantive knowledge and real-world insight on the coordination of the foreign policies of the Member States of the Caribbean Community (CARICOM)

Call for Blogs: The Jindal Forum for International and Economic Laws

October 6, 2021

About us

Afronomicslaw welcomes Salvador Herencia-Carrasco as a Contributing Editor

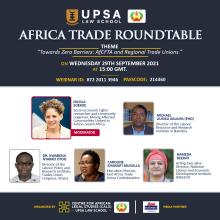

UPSA Law School Africa Trade Roundtable: Towards Zero Barriers: AfCFTA and Regional Trade Unions

September 27, 2021

UPSA Law School presents Africa Trade Roundtable themed "Towards Zero Barriers: AfCFTA and Regional Trade Unions"

Date: Wednesday, 29th September, 2021

Time: 15.00 GMT

To join, click here

NEWS: 9.23.2021

Post-Doctoral and Doctoral Research Fellows: The Legal Dimension of Using Data Science for Health Discovery and Innovation in Africa

September 23, 2021

The Legal Dimension of Using Data Science for Health Discovery and Innovation in Africa

This research project will investigate five critical themes over a three-year period: (1) modes of informed consent to the use of data; (2) the nature and content of individual and community rights in genomic data; (3) the use of persons' geospatial data for public health surveillance; (4) the cross-border sharing of data; and (5) the use of data as basis for Artificial Intelligence (AI).

Call for Application: Short-term Consultancy: Legal and Policy Researcher at the Columbia Centre on Sustainable Investment (CCSI)

September 21, 2021

Paid Short-term Consultancy: Legal and Policy Researcher (Parental Leave Cover)

Key information:

NEWS: 9.16.2021

Call for Paper - Global Anti-Money Laundering Standards: Errors in Transplantation and Unintended Consequences for Developing Countries

September 15, 2021

The Global South Dialogue on Economic Crimes (GSDEC) is pleased to announce its Call for Paper on Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) standards, transplantation errors and unintended consequences.