December 7, 2020

Introduction

The term Digital Service Tax (DST) has fluid meaning in different policy contexts. Sketchily speaking, this term can refer to a taxation guideline and policy on various everyday economic activities that are connected over electronic or internet-connected devices. Primarily in Europe and the field of international tax policy, however, certain types of activities and markets have been singled out for selective taxation by some economies. (Lowry 2019)

Most of DSTs significant propositions are based on several grounds, including the goal of having businesses and corporations, especially multinational corporations (MNCs) pay their due share on taxes, taxing profits derived from consumers activities in their territory, or adapting traditional regulations and systems of international taxation to guide and inform new forms of unsettling business models that can be conducted virtually. This is following the debate that digital firms are undertaxed.

From the structure and definition of DSTs, economic agents may conclude that they are a ‘selective’ tax on revenue (cognate to an excise tax) rather than a tax on corporate profits. Corporate profit is in layman the total revenue less total cost. Thus a tax on profits is a policy to price the return on investment in the corporate sector. On the other hand, DSTs are ‘turnover taxes’ applicable to the revenue generated from all economic activities or taxable business activities without taking costs incurred by a firm into consideration. Rather, via principality, ownership of assets justifies the allocation of taxing rights on a share of the corporate profits.

Following economic theory and general empirical research on excise taxes, DSTs are more than likely to have the same effect as an excise tax on intermediate services. That may lead to an increase in market prices, decreased supply, and consequently reduced investments in the same sectors. The economic incidence of a DST brought by the transaction of taxable services such as but not limited to; companies paying digital economy firms for marketing and advertisement, marketplace listings, and user data and going hand in hand is also the possible consumers’ trickle-down from those transactions. In contrast to a corporate profits tax—which, on balance, tends to be exhibited by higher-income shareholders—DSTs are likely to affect a broad range of consumer goods and services. Moreover, DSTs are expected to be a regressive form of raising revenue.

Analysis and Argument of Kenya’s Sustenance to DST

In a bid to increase public finance, Kenya has in turn also bought into DSTs. That places the question on whether the move is analytically founded and/or if the policy will stand in the just growing economy. Just a proposal thus far, it is still uncertain whether it is an opportunity to the economy or a burden upon citizens. The proposed Digital Service Tax (DST) builds its constructs on the digital market provisions in the Kenya Finance Act (2019). Opponents to the imposition of the levy argument that those are vague and ill-defined provisions that are bound to adversely affect Kenya’s dynamic digital sphere and have introduced legal uncertainty. Basing their argument is how Kenyan authorities have so far failed to regulate who is encapsulated by the digital market provisions (i.e., start-ups, corporations, cloud platforms, etc.,), and the format and structure under which they will be bound to a digital taxation imposition. (Machira 2020)

Since there exists uncertainty and risks, proponents of the policy believe the digital service tax proposal respects the constitution of the state and international human rights obligations such as liability in tax leading to deteriorating living conditions and induced marginalization. Besides, they argue that a DST would promote economic growth by protecting the dynamism of the digital sphere and guaranteeing people’s digital rights by adopting comprehensive, rather than ill-conceived, digital tax measures by bringing up the debate.

Nonetheless, it is necessary to balance diverse public and private interests by ensuring that any digital economy taxes, such as the proposed DST, are founded on a prior and thorough human rights impact assessment (HRIA), including an extensively publicly scrutinized cost-benefit. HRIA is in place to take into consideration the direct and indirect impact of digital tax provisions on people’s human rights and if need be, pending completion of the very assessment, the imposition of a suspension on all existing and proposed digital tax measures at the income tax and VAT levels in Kenya. In its submission, Article 19 Eastern Africa (or EA) urges Kenya to use the Finance Bill (2020) as an opportunity to protect Kenya’s nascent digital sphere and guarantee people’s digital rights. (Mugambi, 2020).

Thus, to ensure that the dynamism of Kenya’s digital sphere, including the Internet, is protected, the clarity for definitions of ‘digital market-place’ and ‘digital services’ should be posed to ensure the legal stance of stakeholders are upheld. taking that, from experience in the Kenyan Taxation system, over the past has severely hinged its citizens’ rights. Fairness, trust, plurality, and innovation are key elements that may only be guaranteed by adopting a differentiated and well-defined tax policy, rather than a ‘one-size-fits-all’ approach to suit minimum requirements at least. A defined approach takes into account the direct and indirect impact of digital tax provisions on people’s human rights, and, consequently, promoting innovation, local entrepreneurship, and protection of users’ freedom of expression. Moreover, the proposal may include a minimum threshold requirement to pay homage to the divergent financial and institutional capabilities of diverse economic actors offering services using digital platforms and technologies, including the Internet. That threshold may consider the profit earned by different economic actors in Kenya and their role in the redistribution of wealth and the promotion of social justice in the country.

Policy and Legal Justification

Justifications to DST lies in the same being a tax on corporate profits in the digital economy, a measure to counteract tax avoidance and profit shifting. DSTs are a method to tax local user-created value as well as an excise tax on the digital economy to enhance progressivity. Besides, that is a tool to curbing thin capitalization, especially to a country that statistically stands to gain hugely from capital following due to its labour-intensive nature and its potential to be an international hub for the sector.

In general, A DST proposal should specify and define what level of enforcement would be necessary for corporations to make good faith efforts to source their revenues to local users. DSTs could present policy tradeoffs between individual privacy concerns and tax revenue collection. So, a high standard of diligence would be required to determine the source of users designed to preserve their privacy that would imply higher costs whereas a lower standard might just require fewer resources from firms. The latter option may be less intrusive on user privacy and, in turn, reduce the amount of tax raised from local users. As so, an exemption based on financial disclosure forms may not accurately reflect taxable income. (Cockfield, 2010)

Economic Efficiency Analysis of a DST in Digital Markets

Following that, in economics there are two extreme market structures that most markets lie somewhere in between, the analysis examines how DSTs would apply for digital markets.

i. Competitive Market

In perfect competition, firms face a downward-sloping demand curve, and the supply curve is perfectly elastic (horizontal) each firm earning no economic profit, meaning that the opportunity cost of investing in alternative ventures is zero, and each is a price taker in the market. In this scenario, when the government imposes an excise tax, firms must ultimately pass on the cost of the tax to their consumers or exit the market. The long-run effects of a DST in a perfect competition scenario with demand curves of different slopes are below.

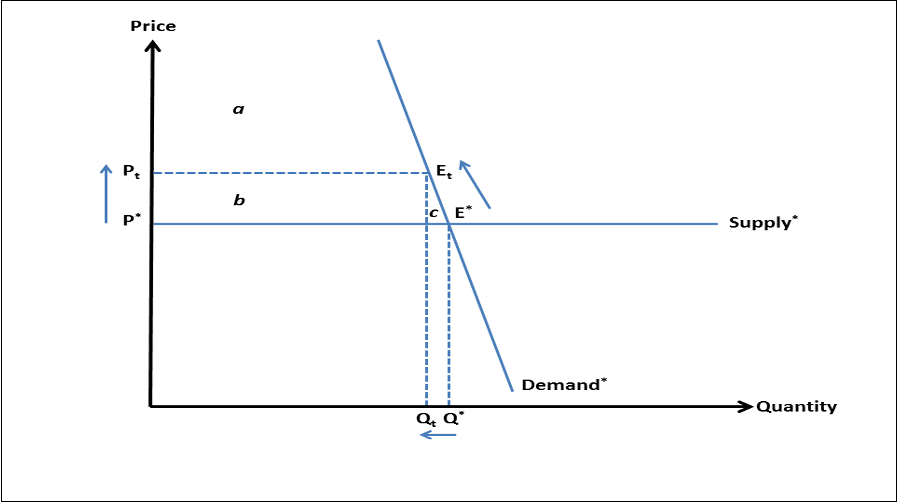

Figure 5.1. Effects of a DST on Long-Run Equilibrium in a Competitive Market with a Relatively Inelastic Demand Curve  Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005).

Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005).

The relatively inelastic demand in Figure 5.1 indicates greater reductions in consumer welfare, more tax revenue collected, and smaller deadweight losses. This is because a relatively inelastic demand curve indicates that consumers are less responsive to changes in price. If consumers are unable to substitute away from goods or services subject to DSTs toward non-taxed activities, then they pay higher prices for taxed activities, and the government collects more revenue.

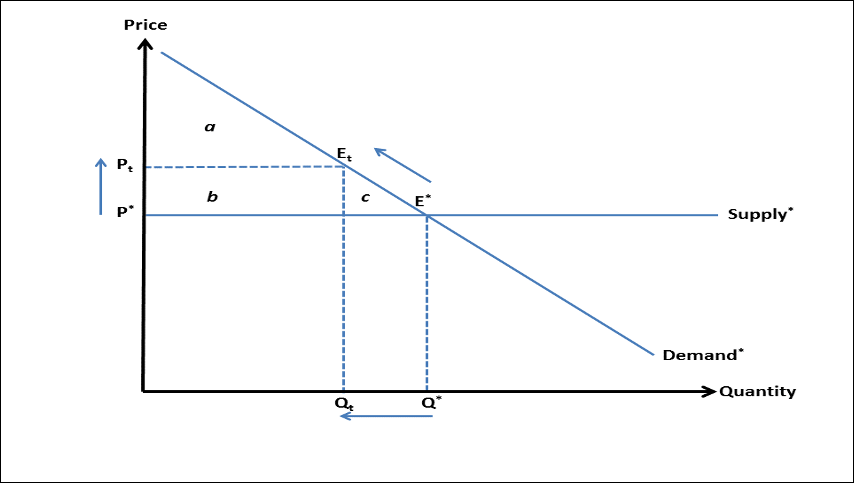

Figure 5.2. Effects of a DST on Long-Run Equilibrium in a Competitive Market with a Relatively Elastic Demand Curve  Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005). The relatively elastic demand in Figure 5.2 shows the imposition of a DST causes prices to rise and quantity demanded to fall in the market. This creates a situation of little revenue collection.

Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005). The relatively elastic demand in Figure 5.2 shows the imposition of a DST causes prices to rise and quantity demanded to fall in the market. This creates a situation of little revenue collection.

ii. Monopoly Market

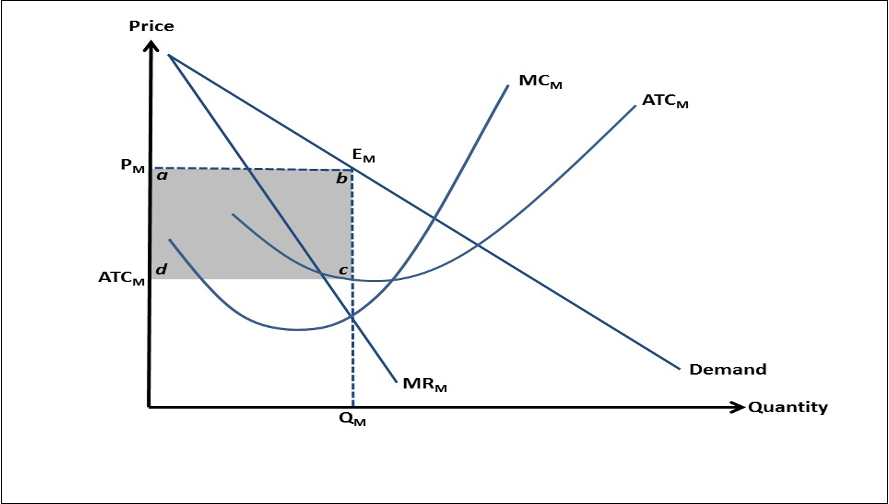

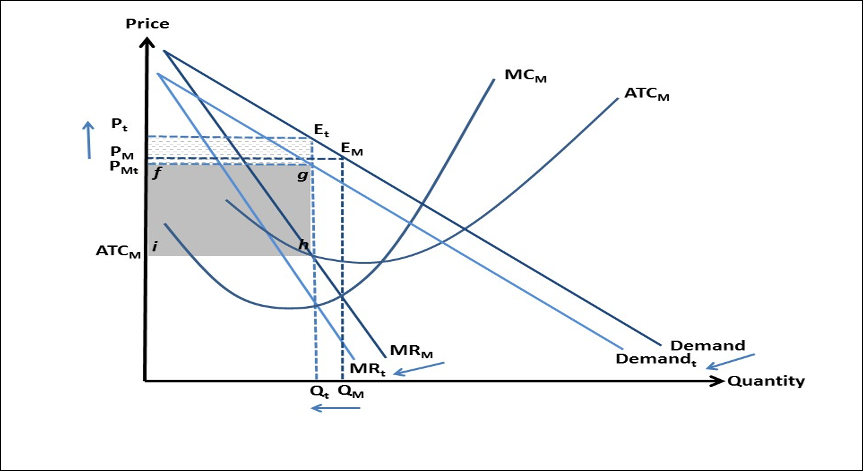

A DST shifts the demand curve in as consumers of taxed services respond to higher after-tax prices in a monopoly market. As a result, the marginal revenue earned by the monopolist declines, and his marginal revenue curve shifts equilibrium in the market drops. The price received by the monopolist, though, decreases creating a deadweight loss relative to a competitive market. When a tax is introduced on top of the distortions caused by the monopolist, the size of the deadweight loss in the market is further increased. At this point, consumers lose welfare whereas the government stands to lose in credibility of public policy. The comparison for before and after-tax positions are illustrated below.

Figure 5.3. Illustrated Long-Run Equilibrium in a Monopoly Market (Before Tax)  Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005),

Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005),

Figure 5.4. Illustrated Long-Run Equilibrium in a Monopoly Market (After Tax)  Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005).

Source: Adopted, in part, from Harvey S. Rosen, Public Finance, 7th ed. (Boston, MA: McGraw-Irwin, 2005).

For a matter of economic efficiency, equity must be upheld. The principle of vertical equity, by and large, implies that households having a larger ability to pay tax should generally pay a larger share of their household income in taxes compared to households with lesser ability. A tax is considered progressive if higher-income households are burdened with a significantly larger share of their income in tax than lower-income households, the converse being true in a regressive tax regime.

If the tax incidence of DSTs is similar to that of an excise tax rather than a tax on corporate profits, this finding also has an impact on the vertical equity analysis of DSTs. Then, following that lower-income households often bear more of their pre-tax income on consumption than relatively high-income households, the DSTs may create a regressive tax regime, thus raise equity concerns.

Another key consideration is that the exact equity effects of DSTs could also vary based on a couple of things such as; different abilities for intermediate firms to pass the tax along with to consumers, the nature of the goods and services that they sell, and the responsiveness of consumers in those relative markets. Take for instance, if say, YouTube charges higher prices for advertising to companies, and companies can pass those costs in full to their customers in the form of price mark-ups then household consumer goods and inferior goods would suffer regressive effects while goods will have more progressive effects. In the aggregate, though, it is an assumption that final consumers of goods and services sold through taxable activities in digitized business models are disproportionately higher-income taxpayers. In the case, it is expected that a DST affecting a wide range of commodities and services is more likely to be regressive than not, especially when compared to a tax on corporate profits.

Also, unequal firms’ treatment following those within the digital economy against those without, which is thus far only arbitrary in Kenya, may be an incentive to shift profit as well as engage in transfer pricing aggressively rises to reduce their tax liability to the Kenyan economy and tax revenue authorities. In some cases, the big digital companies left the market, i.e., Amazon left Australia.

Final Remarks

For the case of Kenya, a middle-income country [and economies having such characteristics and similar economic power, DSTs are a constraint to its economy as it is an impending liability. In the future, with better economic and legal reforms, the imposition of such taxes may be progressive and an asset to the government and revenue authorities in the collection of funds for public expenditure, however, as it stands, it may require more scrutiny, planning and public reforms to execute it to a very economy that has a large percentage of its citizens just above the poverty line with a significant number below the dollar-a-day line.

DSTs are a viable policy in any economy as it considers undertaxed firms and assists regarding guidelines on how such firms are taxed. In any case, the world, as a global village should adopt it. This study however points out that some economies, taking Kenya’s example, that this is a little forward in time for some economies. Also, this analysis recommends that for the imposition of DST, more variables should be considered, including legal implications on the economic structure.

This study also invites scholars and market players to do further research on ideals for the imposition of DSTs and such taxes, now or in the future.