02 July 2025

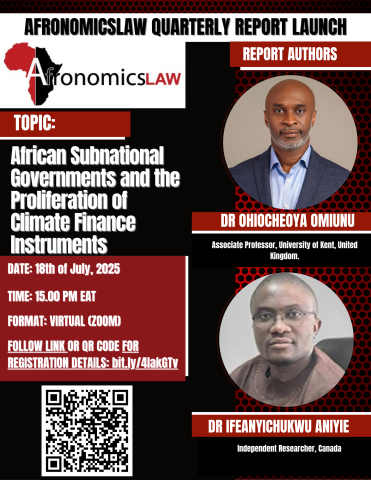

Date: Jul 18, 2025

Time: 03:00 PM Nairobi, 2PM Harare, 1PM London

Meeting Link: bit.ly/4lakGTv

Meeting Description

Join us for the launch of Afronomicslaw’s latest quarterly report, “African Subnational Governments and the Proliferation of Climate Finance Instruments: A Case Study of the Tanga UWASA Water Infrastructure Green Bond” by Dr Ohiocheoya Omiunu (Associate Professor of Law, University of Kent; Editor, Afronomicslaw.org) and Dr Ifeanyichukwu Azuka Aniyie (Independent Researcher, Canada).

With African non-central governments (NCGs) (i.e., sub-states, regions, cities, municipalities, local governments, etc.) increasingly vulnerable to climate-induced impacts, there is a pressing need for local adaptation and mitigation financing that aligns with both environmental and socio-economic priorities. This need has precipitated a shift towards climate finance instruments to meet the funding deficit for local adaptation and mitigation projects at the local level. A case in point is the Tanga UWASA bond, East Africa’s first subnational water infrastructure green bond. Touted as an important step towards local revenue mobilisation for green projects from the domestic debt market, this instrument raises critical questions about debt responsibility, the prioritisation of bankable projects over community needs, and the risk of financialisation of essential public utilities.

This study explores whether the Tanga UWASA Green Bond represents true domestic capital mobilisation or entrenchment of foreign financial dependence, given its recent listing on the Luxembourg Stock Exchange (LuxSE). Additionally, the report addresses the hidden transaction costs, the crowding-out effect on private capital, and the potential for socio-economic displacement tied to investor-driven return imperatives. By evaluating the bond’s structure against international green bond standards and Tanzania’s Five-Year Development Plan, this report critiques the potential of green finance to balance debt sustainability with meaningful environmental and social outcomes.